Can foreigners buy property in South Africa? Yes, any person who enters South Africa legally and wishes to acquire property, is able to do so, in either their personal capacity or in the name of a legal entity.

If you want to find out how to buy property in South Africa, then this article will help you understand the process from start to finish.

Everything you need to know about buying a house in South Africa for foreigners

We’ll mainly dive into private property acquisitions in this post, so if you’re wanting to buy a property to use yourself, or to rent out, then here is everything you need to know.

How do I find the right real estate agent to assist me in buying property in South Africa?

To start the process of acquiring property in South Africa, find a reputable, licensed real estate agent, who is knowledgeable and capable of securing your ideal property, with the least fuss. Your estate agent must be a registered member of the PPRA and be in good standing and hold a Fidelity Fund Certificate.

The long-awaited Property Practitioners Act finally came into effect this year and brings with it significant changes to the real estate industry. The Act takes a more consumer-focused approach and is premised on the need for transformation in the property sector.

We at Team Hot Property hold all of the necessary qualifications and also have years of experience between us. We also converse in numerous European and South African languages, including, German, Portuguese, Xhosa, English, and Afrikaans.

Which area in South Africa is going to suit me?

Cape Town has many beautiful areas and it can be a difficult decision to choose the most suitable area in which to purchase.

The Cape metropole can be divided into a few sectors. Should you be looking for a relaxed seaside area which attracts holidaymakers, then the Atlantic Seaboard is probably going to be the best area to focus.

It is, however, a large area and has varied price ranges, from affordable properties in Green Point and Sea Point, to world-class luxury houses along the coastline, stretching from Llandudno, through Camps Bay, Clifton, Bantry Bay, Fresnaye, Green Point, within the V&A Marina and further north, to the Blouberg area.

- Clifton is known mainly for its beach bungalows which have long ago lost their “bungalow” status and are now sought-after homes with every convenience and international property price tags. There are magnificent homes clinging to the mountainside and the apartments along the world-famous beaches of Clifton are extremely popular as full-time residences and homes away from home.

- Camps Bay, Fresnaye and Bantry Bay offer excellent opportunities in the upper price range, for those seeking large family homes or spectacular showcase homes. However, there is a regular supply of midrange properties where a good entry can be found on the seaboard, which offers easy access to nature, shopping centers, schools and medical facilities.

- Mixed-use developments have become very popular recently and are popping up all over the seaboard and City Bowl and offer an excellent opportunity for those requiring more of a convenient community lifestyle.

- Sea Point and Green Point remain good value for money and continue to offer good investment and residential opportunities in the mid sector of the property market with both apartments and freestanding houses in a wide price range. This is a very popular area for investors who are interested in acquiring a holiday apartment to rent out during the summer months, when demand continues to grow as visitors from all corners of the world descend on Cape Town for the summer. The most popular tourist attractions along the beachfront are in easy reach and the world-renown Sea Point promenade is within walking distance from most properties in this area.

- Ever popular, the V&A Waterfront is where a highly secure and luxurious lifestyle is on offer. Investment properties are highly sought after in this area and rental demand is generally strong, due to the lack of loadshedding, the excellent security, access to motorways and the high-end calibre of the accommodation on offer.

- Many students and young professionals or couples starting out prefer to live in the City Bowl and Vredehoek, Gardens area, where the focus is on affordable properties with pockets of high-end luxurious properties, mostly in the elevated areas, ie the rooftop penthouses and beautiful established homes on the slopes of Table Mountain in Higgovale and Tamboerskloof.

There is truly a property for everyone and all tastes and price ranges are available within the Cape Town area and surrounds.

How long are my stays going to be if I own property in South Africa?

If you are planning to visit your property regularly, you may have to make an application for the relevant residence permit.

If you are only going to be visiting for a few weeks per year, you probably won’t have to make any changes to your status as a tourist. South Africa does not offer automatic residency or even automatic entry to foreigners who own property within its borders.

What do I need to purchase a home in South Africa?

In preparation for the process, your agent will require some background info on you as the buyer and will request to see your passport. If applicable your visa will also be required. They will also check on your marital status as this may influence your decision on whether to purchase in your own name or in both you and your partner’s name. You will be required to present all the relevant FICA documents as well.

You might be wondering “what does FICA stand for in South Africa?” They are also referred to as “know your client” documents as no property transaction will be registered in South Africa in the absence of full FICA. It stands for Financial Intelligence Centre Act and ensures that you are who you say you are – preventing terrorist activity and money laundering.

Which documents are required for FICA?

Depending on whether you are purchasing in your own capacity or in that of another legal entity, the FICA requirements will vary, however, in all cases, the people involved including those who represent legal entities, will all have to present their proof of identity and their proof of physical address, wherever that may be in the world.

For more information please read the FICA guidelines.

How do I intend to finance my property ownership in South Africa?

We assist with introducing you to suitable bond originators should you wish to finance a portion of the purchase price (the absolute maximum allowed is 50% of the purchase price as a non-SA resident).

Team Hot Property works with various currency brokers who assist with safe and affordable fund transfers to South Africa.

What happens once I select a property?

As soon as your dream property has been identified an ‘Offer to Purchase’ document has to be signed up.

All contracts to purchase land have to be written documents which address the property information and the details of the owner and purchaser, the agreed price and the terms of the acquisition. These documents have to be signed by all the parties, to be legally binding.

Is a deposit required to secure a property?

Although the amount of a deposit paid on a property acquisition is generally no less than 10% of the purchase price, paying a deposit is not mandatory. However, sellers will find a purchaser more credible should a deposit be offered and your agent will generally recommend that a deposit is paid.

Including a deposit in the offer does also indicate to the seller that the purchaser is serious, committed and has the financial means to go through with the sale upon acceptance of the offer by the seller. The deposit will be invested by the attorneys or agency and the interest earned on such funds will be for the credit of the purchaser, unless otherwise negotiated or stated in the sale agreement.

When do I pay the balance of the purchase price?

Your agent will assist you with the completion of the payment clause in your ‘Offer to Purchase’, which will include when the balance of the purchase price is to be paid, how it is to be secured and where or with whom the funds will be held until the date of transfer.

A guarantee is usually called for and this is provided by a local bank, if you are transferring your funds to South Africa, or a back-to-back guarantee may be provided by your own foreign bank to a South African bank, if the funds are not immediately being transferred to South Africa.

These back-to-back guarantees are generally rather expensive and we recommend that you discuss your options with your agent, who has access to currency brokers who are highly experienced in international fund transfers and often handle the movement of your funds at a lower cost than the banks would be able to.

When should I take occupation of the property?

Your agent will alert you to the circumstances surrounding the occupation date of the property. In most cases the property becomes available for occupation by the purchaser at date of transfer but often, as in the case of absent owners, or where properties are vacant, the date of occupation can be negotiated for a date prior to the date of transfer.

Occupational interest could be compared to the rental payable by the party occupying the property belonging to another, which covers the period during which the transfer of ownership of the property is in process.

On the date of occupation, full physical occupation of the property is handed to the purchaser, i.e. the purchaser is handed the keys and may occupy the property or portions of the property, as agreed to in the sale agreement, at the agreed rate of occupation.

The date of possession, however, is generally deemed to be the date upon which the property transfer is registered, i.e. ownership, and that is usually the date on which all responsibility passes to the purchaser, e.g insurance of the property and structure remains the responsibility of the seller, until date of registration of the transfer.

The actual date of registration of ownership in the Deeds Registry in favour of the purchaser, is the date of transfer.

What does “Voetstoots” mean?

The South African legal system is based on Roman-Dutch law and in addition to Latin legal terms there are also a few Dutch legal terms. “Voetstoots” is a standard inclusion in all sale agreements and implies that the property is bought ‘as is’. This refers to the condition of the property as seen by the purchaser.

Where there is an agreement between the seller and the purchaser that certain items be changed, e.g items or defects are to be repaired, these can be noted in the ‘Offer to Purchase’ as a special condition.

The Consumer Protection Act applies to sale agreements where the seller is in the business of selling land, such as a developer. In such instances, the seller is obliged to provide the purchaser with property that is free from defects, as defined in the Act.

Which items have to remain in the property?

In contrast to many international countries, properties are sold together with all fixtures and fittings of a permanent nature, in South Africa.

This refers to kitchen units, light fittings, shelves, curtain rails, blinds and the list is extensive, even covering items such as rainwater tanks and cable TV antennae.

The seller may alert the purchaser at the viewing or at the time of the offer being negotiated, that a particular item is going to be removed but in general this is not the norm and to avoid any uncertainty, the purchaser is cautioned to check that all items intended to be included in the purchase price are specified in writing in the sales agreement and anything that is to be removed by the seller, is documented.

Purchasing fully furnished and equipped property should be discussed with both your agent and the transferring attorney in order to assess the tax and cost implications at the time of negotiation and prior to signature of the ‘Offer to Purchase’.

What is the Condition Report?

All property transactions have to include a Condition Report as per recent legislation. This report allows the owner of the property to reveal any defects or other relevant items in the property which he may be aware of, at the time of offering the property for rent or sale. The document is signed off by all the parties to the transaction as it is a snapshot of the general condition of the property.

As a prospective owner of a property, the purchaser will also have to submit a Condition Report once he offers the property to tenants, should he be planning to rent out the property during his absence.

Can I cancel an Agreement of Sale?

Once an Agreement of Sale or Offer to Purchase has been signed by both parties, neither party can withdraw without penalty, which is generally described in the agreement. This agreement would become null and void, should either of the parties not fulfill conditions of the agreement, when called upon to do so.

How do I purchase property in the name of a legal entity (eg. a company)?

The process is very similar to the above, however, there are requirements and procedures which must be complied with in certain circumstances, such as the local registration of entities registered outside of South Africa where they purchase property in South Africa, and a South African resident public officer has to be appointed for a local company where shares are owned by a non-resident.

We can assist with introductions to attorneys who will register your company correctly and recommend an attorney is appointed where property is being acquired by a legal entity. Property can be owned in many different vehicles, i.e. individually, jointly in undivided shares or by an entity such as a company, close corporation or trust or a similar entity registered outside South Africa.

How does the property become registered in my name?

The Deeds Registry offices of each of the provinces of South Africa keep the records of ownership and transfers of land, where every piece of land in the country is reflected on a diagram.

This is available for public viewing and the appointed attorney will call for the relevant Deed of Transfer from the seller, which will match the record in the Deeds Registry. South Africa is reputed to have one of the best deeds registration systems in the world.

Most property ownership transactions in South Africa have to be concluded in writing and even where it is not a legal requirement (eg. purchase of shares or other property ownership vehicles) we would recommend that a written agreement is concluded across the board. The acquisition of property shares are not recorded in the Deeds Registry.

What does the transfer process entail?

An attorney who is qualified in the transfer of immovable property is referred to as a conveyancer. The seller appoints the conveyancer, who will prepare all the legal transfer documentation and attend to the signature thereof by the parties.

The tax clearance certificates on the property are obtained from the local municipal authorities by the conveyancer, in order to clear the property of any rates and taxes debt. In addition they will ensure that any existing loans (mortgage bonds) the seller may have on the property are cancelled and that the new mortgage bond (where applicable) is registered on behalf of the purchaser.

The documents for the transfer of the property are lodged with the relevant Deeds Registry for scrutinization and recording of the transfer of the property.

On the date of registration of transfer all existing mortgage bonds registered over the property are cancelled simultaneously with the registration of any new mortgage bond by the purchaser, in favour of the institution granting financial assistance. The purchaser is recorded as the new owner of the property. On the same day, the seller is paid the balance of the purchase price.

When do I sign transfer documents?

As soon as the Offer to Purchase has been signed and the deposit paid, the process of signing transfer documents begins. The transferring attorney and if finance has been sought, the bond attorney too, will make contact with the purchaser and make arrangements for these documents to be signed.

Where the documents are going to be signed outside of South Africa, there are regulations and formalities which have to be kept in mind in order to ensure that the documentation complies with the laws of South Africa.

This documentation is required to be signed in black ink, on original documents and certified by either a Notary Public or the head of the South African diplomatic or consular mission or consul-general, consul, vice-consul or consular agent, who will authenticate the documents by means of a certificate attached to the documents. These are to be issued and signed by, and bear the relevant seal of office.

It is highly advisable, to make arrangements prior to leaving South Africa, granting a General Power of Attorney (GPA) in favour of a trusted person in South Africa to assist with signing transfer and bond documents on your behalf. This having been said, it is important to note that no person is allowed to sign an affidavit on someone else’s behalf, even if a GPA has been granted.

Where the purchaser is married according to the laws of a foreign country the spouse of the purchaser will be required to assist the purchaser in signing all transfer related documents.

It is important to note that under no circumstances may anyone sign an Affidavit on behalf of another, so prior arrangements should be made while in South Africa to address this item, if required.

What are Certificates of Compliance COC’s and who pays for obtaining them?

Purchasers are offered a certain amount of protection on purchasing property in South Africa, under the regulation covering Certificates of Compliance, which the seller is required to provide and generally also pay for, including any repairs that are required in order to obtain the certificates, although the parties contractually agree otherwise.

These certificates consist of the following:

- A valid electrical compliance certificate certifying that the electrical installation at the property meets certain statutory and safety requirements.

- A compliance certificate must also be obtained where there is an electric fence installation on the property. In Cape Town in particular, a certificate of compliance of water installation must be provided

by the Seller, to the municipality before transfer. - Should there be any gas appliance installation at the property, a gas certificate of compliance is to be obtained, confirming that the installation complies with the statutory safety requirements.

- In certain regions and for certain properties, a beetle- free certificate may be required. This certifies that all accessible parts of the property are free of infestation by certain defined beetle. Beetle- free certificates only apply to properties in the Western Cape and KwaZulu-Natal provinces and do not apply to sectional title properties.

Who pays for the registration of the transfer of property?

The purchaser pays the conveyancer for the costs of transferring the property into their name, unless contractually agreed to otherwise. These costs are called conveyancing fees or transfer fees. Should the purchaser have opted for financing the property, they will pay the mortgage bond registration fees. The fees are determined according to the purchase price of the property and determined by a tariff guideline as issued by the Law Society.

For more information, view the example fees.

Who pays mortgage or loan cancellation fees?

The cancellation fee of a mortgage loan or other loans over immovable property, is generally payable by the seller. The seller notifies his financier that he has sold the property, or the conveyancer may do so and the cancellation figures are provided to the conveyancer, in order to make provision for the funds to cancel the loan.

It is advisable that the seller alert his financier three months prior to bond cancellation, of his intention to cancel.

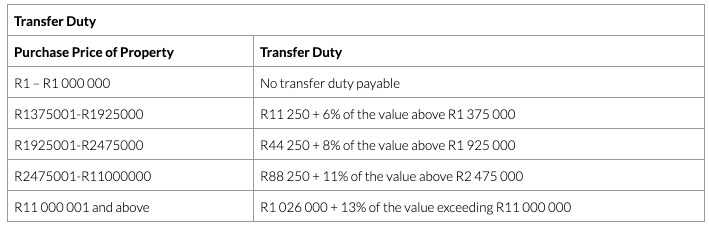

Who pays the transfer duty to SARS?

Transfer duty, a tax that is payable to the South African Revenue Services, (SARS) is payable by the purchaser. Transfer duty is payable on the acquisition of property whether by an individual or entity.

Either VAT (Value Added Tax) or Transfer Duty is payable on property acquisitions.

VAT is calculated at 15% of the purchase price. VAT is payable on a property acquisition transaction if the seller is a registered VAT vendor and the property being sold forms part of the seller’s business.

Who pays the brokerage fee/sale commission?

Your real estate agent has successfully brokered the property transaction, usually in terms of a selling mandate and is due their fees upon registration of the property transfer. Brokerage is customarily payable by the seller who mandates the estate agent to procure a purchaser for the property.

Should the parties, however, agree that the purchaser settles the selling agent’s commission, there are certain tax implications pertaining to transfer duty and capital gains tax will follow.

What taxes are payable upon selling the property?

Income and the tax on this gain, as well as the profit on a later sale of the property, is referred to as Capital Gains Tax. The inclusion rate depends on the type of owner and the individual circumstances.

For individuals it may be slightly complex due to the employment of a progressive sliding tax scale and we highly recommend this discussion be undertaken with your transferring attorney’s tax partner.

Withholding tax is payable by all foreign sellers.

What is Withholding Tax?

The transferring attorneys, together with the estate agent, are obligated by regulation, to withhold a percentage of the proceeds in property transactions where the seller is a non-resident and where the purchase price of the property exceeds R2 000 000.

Withholding tax is deducted from the proceeds of the sale, where the conveyancer will withhold a percentage of the proceeds of the sale and pay it over, on behalf of the seller, to the South African Revenue Services.

These funds are regarded as provisional tax in lieu of the seller’s future tax liability and the final calculation is arrived at once the non-resident submits their tax return, indicating the actual profit and liability figures, on the property transaction.

The withholding tax obligation is made on the gross selling price and the applicable base withholding rate depends on the legal status of the non-resident.

It is important that the non-resident property owner discuss the withholding tax with the tax partner of the conveyancer, to form an idea of the process and the figures involved and to obtain further clarity on this process.

Do foreigners pay tax in South Africa?

When a non-resident accrues income in South Africa from a property investment, income tax becomes payable. Profit derived from the initial investment and the profit on the ultimate sale thereof is taxable and is generally referred to as Capital Gains Tax.

Income generated through a scheme of profit-making is classified as normal income and would, for example, include salary or rental income, which is 100% taxable, whereas, for example your pension, as a foreigner, is tax-exempt in South Africa.

The sale of a capital asset gives rise to a capital gain which is taxed slightly differently and your tax advisor will assist with this specific calculation.

Non-residents earning any income at all derived from a source in South Africa are obliged to register as a taxpayer in South Africa.

What is Capital Gains Tax?

Immovable property situated in South Africa, including any right or interest in immovable property is generally taxed at:

- 7.5% if the non-resident seller is an individual

- 10% if the non-resident seller is a company

- 15% if the non-resident seller is a trust

Read more information about Capital Gains tax here.

Can a foreigner buy a house in South Africa? Yes, they can!

If you’re wondering how to buy land in South Africa, then we can help you make your dreams come true. While there is a process that you need to follow if you wish to become a homeowner in a foreign country, if you have the right people on your side, you can make it happen.

If you are looking for real estate for sale in South Africa, reach out to us to get the process started.

0 Comments